Creating a Promotions Strategy

How to create a promotions strategy that works

You may have the greatest product ever but if you don't tell the world, it will sit on the shelves collecting dust until you finally have to close your business. Remember, you know what is great about your business because you created it. The rest of the world is not thinking about you and what you have to offer. So you have to tell them and you have to tell them in a way that makes them want what you have to offer.

Many small businesses shy away from promotions thinking they can't compete with the advertising, public relations and promotions budgets of their large competitors. But good promotions do not have to be expensive. And if you stay focused and create a clear plan, they don't have to be time-consuming either.

First develop a plan. This should be included in your business plan. Here are the steps to developing a strong promotional plan:

Identify your target buyer

Consider what kind of customer you want to do business with and to whom your product or service is most likely to appeal. Take into account demographic (i.e. age, gender, location, marital status), lifestyle (i.e. athletes, club goers, outdoor enthusiasts) and psychographics (i.e. personality traits and emotions that affect buying decisions) information.

Make Them Want What You Have to Offer

Distinguish your product or service from all the rest. This has to be meaningful and accurate, otherwise you will lose credibility with your consumers. First you will need to know what features, benefits and brand attributes your target buyers consider when making a purchase. For example, if you are a local nursery, your target buyers might take into account return policies on plants that don't survive, quality of plants in store and availability of informed people who can assist them with plant choices and directions for caring for the plants.

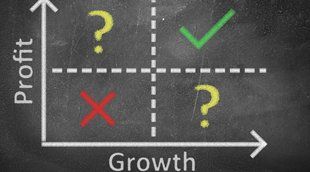

Create a strategy and make it clear

Write down who your target buyers are, what your competitive environment is and what your meaningful differences are. This is called your positioning strategy statement. You must develop a consistent message and look and feel in all of your promotional campaigns.

Think about the personality of your business in relationship to your target buyers. Is it a young, hip, friendly, casual environment? Or is it a more reserved, traditional and slightly more conservative environment? These characteristics will inform the look, feel and tone of your business, as well as promotions.

Create a clear, concise and memorable message that impacts your target buyers

This can be a challenge but doesn't have to be. Think about your business value proposition (BVP). If you have clearly identified the unique features and benefits of your product/service that truly matter to your target buyers, you will be well on your way. Take this information and brainstorm potential slogans, keywords in all marketing messages and visual images that correspond to your BVP.

Consider your budget

When promoting your products, services and business there may never seem to be enough money. However, not all promotion costs money. Creating a mix between word-of-mouth, customer referral programs, public relations and advertising will save you a lot of money. Imagination and relationship building are the keys.